Why Do You Need Market Replay Feature

Market Replay feature in NinjaTrader is the most powerful and almost unique feature comparing to other platforms. Using this feature it is possible to playback a market activity of multiple instruments for some period in the past. Playback speed could be from a real time up to 500x. (Note: for the most of other platforms a similar feature has a name – “market playback”)

Market Replay feature makes it possible to:

- test indicators and strategies in simulated run-time environment

- learn how to trade manually

- enhance your trading skills

- use it for trading education purposes

About MarketReplay Add-On

Our MarketReplay Add-On enhances this powerful feature in NinjaTrader by allowing to download multiple days and multiple instruments at once. Our Add-On is naturally embedded into NinjaTrader platform and uses a standard installation technique similar to other 3rd party indicators and strategies. Download MarketReplay Add-On Now.

For more information please visit Q&A section.

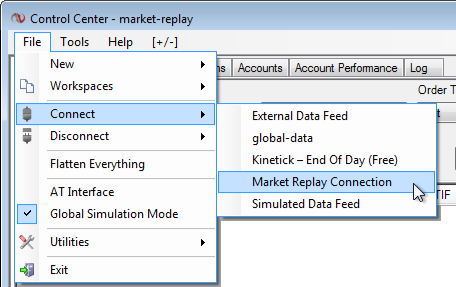

Market Replay Connection

“Market Replay Connection” in NinjaTrader allows to playback downloaded L1 and L2 data streams for a specified symbol or symbols. All indicators and strategies would work similar to a standard SIM operation in real market.

Market replay data is different from historical market data. To get a historical market data, a current connection to a brokerage or data provider is necessary. However, Market Replay feature doesn’t require neither account nor active data connection.

Market Replay data contains L1 (tick data) and L2 (market depth) data streams. According to NinjaTrader Help Guide, L1 and L2 data may be not in full sync, however, it is guaranteed that a sequence of events in L1 are in correct sequence for the corresponding instrument. Even though the sequence of events in L2 is correctly sequenced for the instrument, due to one second granularity of a composite data, created out of those two data streams events in a combined stream, may occur not in a correct sequence. If a real-time strategy rely upon both, L1 and L2 data at the same time, and requires a granularity less than one second, it may perform differently from what has been expected.

- Start a simulated session from a specified date and time

- Verify what data is available

- Test an automated strategies

- Run simulation up to 500x times to the normal speed

- “Fast forward” the market to a specific point, where a trade could be potentially placed in simulation

For more information please visit NinjaTrader Help Guide: http://www.ninjatrader.com/support/helpGuides/nt7/index.html?market_replay.htm

A Help Guide has a nice video tutorial.

Best Practices:

- Don’t download too much of the data because NinjaTrader Market Replay performance will be slow.

- Download only necessary set of instruments for the replay session. For example, if a trader has a plan to trade only /ES, a secondary instruments could be considered as /ZB, /YM, /NQ and /TF. However, having /GC and /SI data at the same time is not necessary. MarketReplay has a local cache for all downloaded data, and any subset of data could be retrieved from there. A local cache contains the data in compressed format with compression ratio about 2:1. When data is available in a local cache, the actual download not needed because requested data will be uncompressed and placed into corresponding folders automatically.

- Use L2 NinjaTrader data only when it is needed (read a note above).

Free Version

You can download and install Free Version from here